Transfer Of Shares Companies Act 2016

Companies act 2016 s.

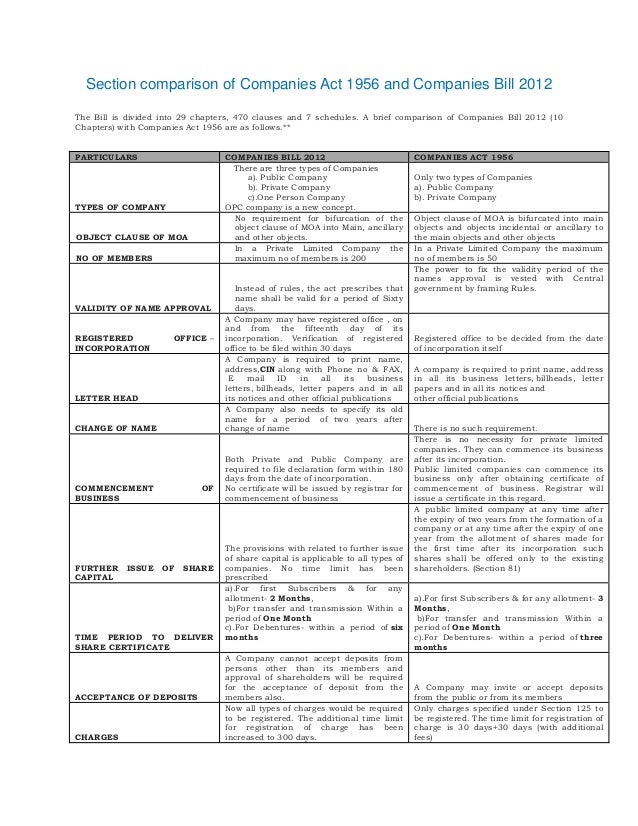

Transfer of shares companies act 2016. Companies act 2016. If the transferor or transferee is a body corporate the execution of this instrument. Companies act chapter 81 01 laws of trinidad and tobago current authorised pages. Issuance of share certificate companies act 1965 shares certificate must be issued.

Under the old companies act 1965 shares are issued with a par or nominal value and. Investment company act the 1940 act. 7 of 2016 seenote on page 2. Par value is the minimum price at which shares can be issued.

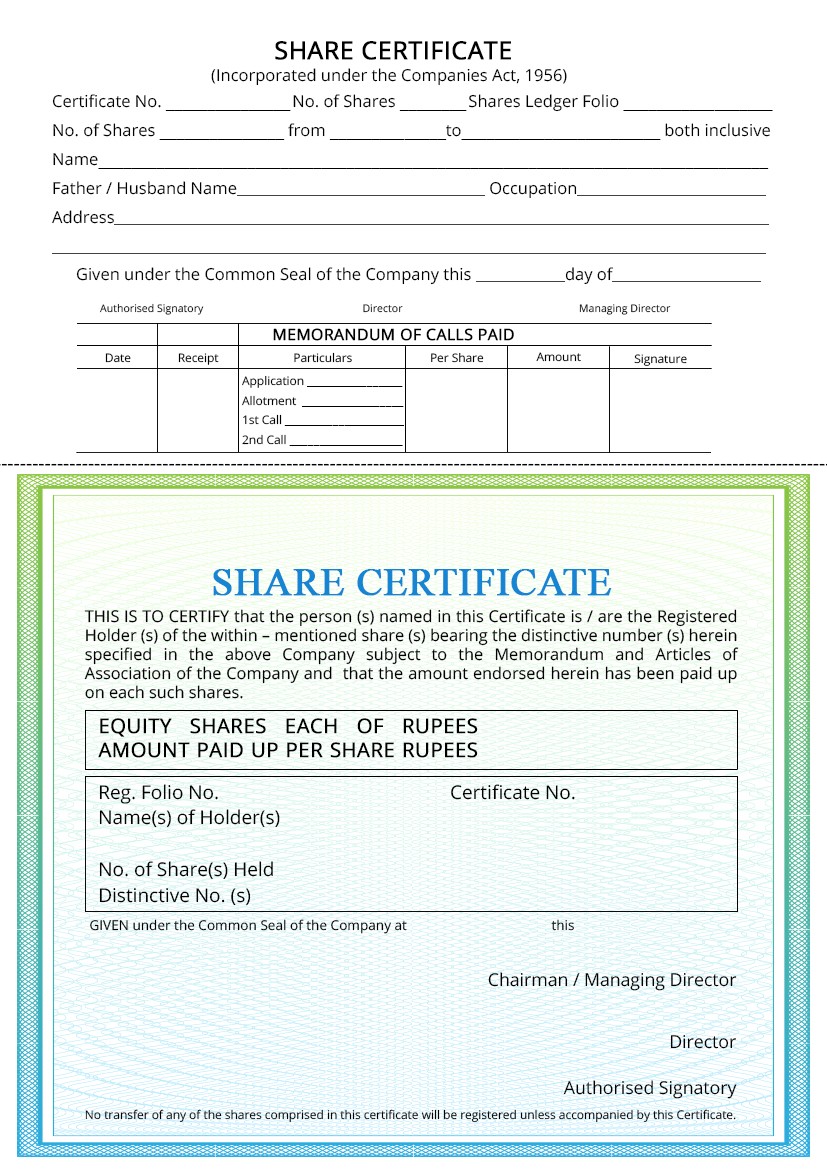

Companies act 2016 section 105 form of transfer of securities 1. In this article we outline the major changes relating to the management and restructuring of share capital under the companies act 2016 new act. A company shall not be required to issue a share certificate unless an application by a shareholder for a certificate relating to. Division 9 transfer of shares and debentures 195.

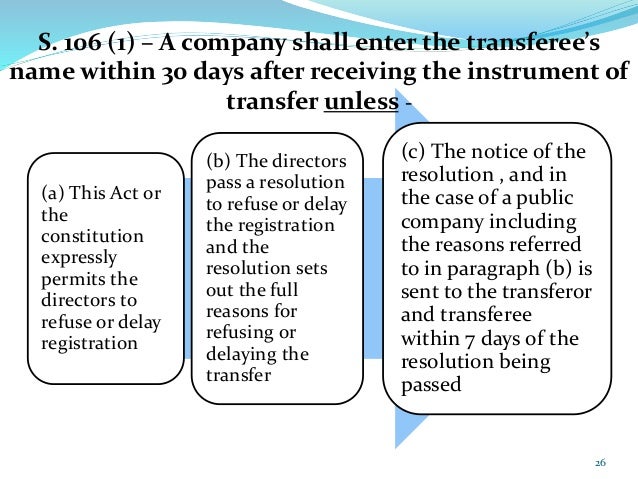

Within 2 months from allotment. No par value for shares. 1 when a transfer of shares in or debentures of a company has been lodged with the company the company must either a register the transfer or b give the transferee notice of refusal to register the transfer together with its reasons for the refusal as soon as practicable and in any event within two months after the date on which the transfer is lodged with it. Companies act 2016.

The company secretary will at the request of the directors to prepare the board resolution for directors to approve the transfer of shares and the form 32a to be signed by existing shareholder new shareholder for the relevant shares to be transferred. 1 subject to any restrictions in the company s constitution and this section a member may transfer all or any of his or her shares in the company by instrument in writing in any usual or common form or any other form which the directors of the company may approve. Within 1 month from a transfer of shares. The stockholders may transfer the shares or any part of the shares in the same manner as the transfer of shares from which the stock arose may have been.

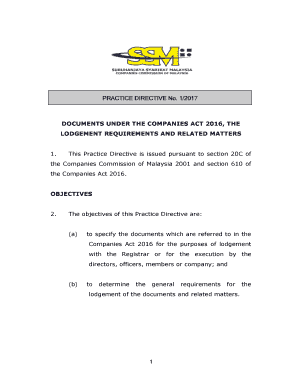

Many of the issues discussed in this guidance were brought into focus by a recent sweep examination of a number of mutual fund complexes investment advisers broker dealers and transfer agents. Stock a company may by resolution convert any paid up shares into stock and reconvert any stock into paid up shares of any number subject to the constitution section 86 1 ca 2016. Stamp act 1949 for the stamp duty chargeable on sale of any stock shares or marketable securities. Procedures on resignation of secretary under section 237 of the companies act 2016 pdf 5.

-act-2014/erom.png)