Rental Income Tax Computation Malaysia

Foreigners and those not residing within malaysia are also charged a flat 28 tax on rental income.

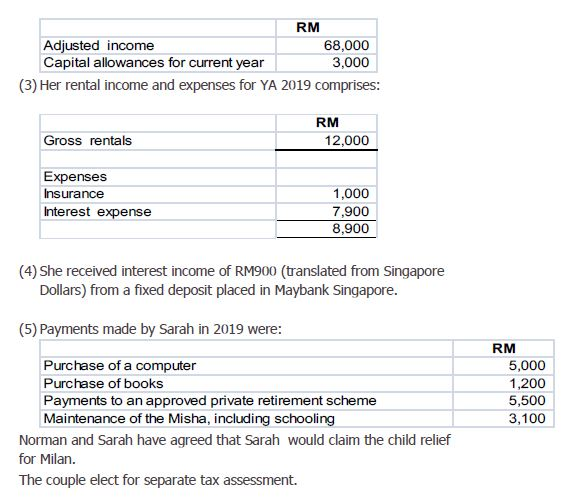

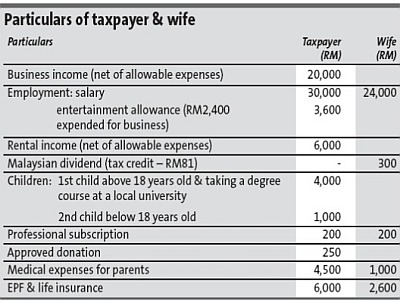

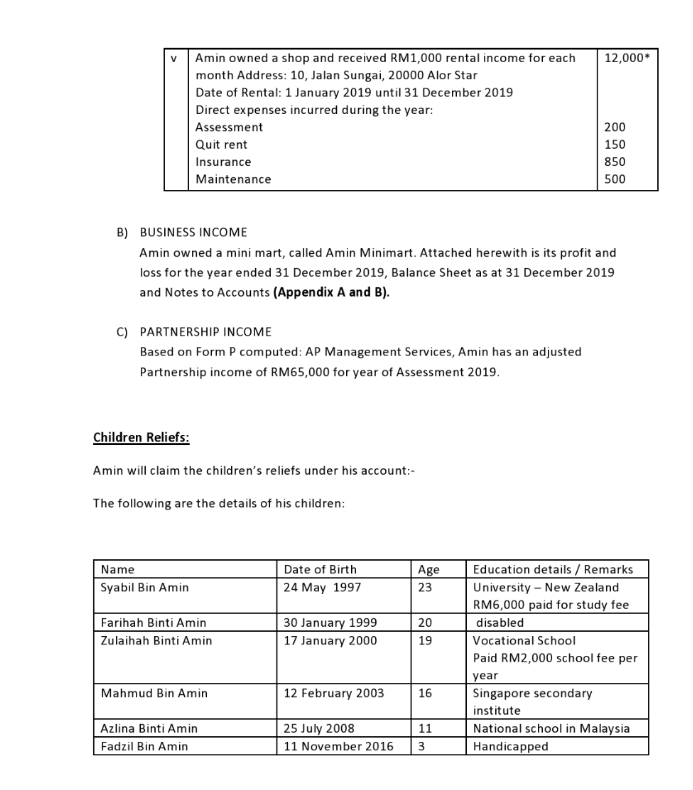

Rental income tax computation malaysia. Individuals who own property situated in malaysia and receive rental income in return are subject to income tax. Example 7 azrie owns 2 units of apartment and lets out those units to 2 tenants. Their tax treatments are as follows. Qualification for 50 income tax deduction.

To take advantage of this there are some requirements to meet. Rental income from residential home received by a resident individual is subject to income tax under the section 4 d of the income tax act 1967 based on progressive rate ranging from 0 to 28. For simplicity just remember that rental is in its own category and has its own progressive tax rate that ranges between 0 and 28. The tenants are entitled to use the swimming pool tennis court and other facilities.

It depends on whether or not adam s tax on rental income from this property in malaysia is under section 4 a business income or section 4 d rental income because they would be treated differently. Inland revenue board of malaysia date of publication. What about the income tax exemption. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967.